WalletHub: Credit & Budgeting

WalletHub is the first app to offer 100% free credit scores, WalletScores, and full credit reports updated daily. Plus, get access to best-in-class budgeting tools and a personalized plan to improve your credit score, pay off your debt, and save money. Download this award-winning app and reach top WalletFitness®.

Sign up for a free WalletHub account to get:

• Credit scores, updated daily

• Clear plan for improving your credit score

• Personalized budget

• Spending tracker

• WalletScore for a full picture of your financial health

• Credit card recommendations

• Loan recommendations s

• Full credit reports, updated daily

• 24/7 credit monitoring to warn you of identity theft and fraud

• Savings alerts so you can avoid overpaying

• Debt payoff roadmap

• Net-worth tracker

10,000+ News Mentions:

• The Wall Street Journal

• The New York Times

• The Washington Post

• CNBC

• Yahoo Finance

• MSN Money

• USA TODAY

• Reuters

• Fox News

• Many more

Frequently Asked Questions:

Q: Will Using WalletHub Hurt My Credit?

A: Not at all. Checking your credit via WalletHub creates a “soft” inquiry that does not affect your credit score in any way.

Q: Why WalletHub?

A: People love WalletHub for three main reasons: 1) we always put our customers first; 2) we make the complex simple; and 3) we offer a number of features that competitors lack, including our proprietary WalletScore and the combination of credit, budgeting, and identity theft protection tools all in one place.

Q: What Is A WalletScore?

A: WalletScore is an innovative tool that tells you how financially healthy you are, based on your:

Credit: Your creditworthiness impacts your ability to borrow at a good price when you need to.

Spending: Your ability to live within your means is key to your financial health.

Emergency Preparedness: You need to be able to handle a financial emergency with your savings, insurance policies, etc.

Retirement: Can you retire at a reasonable age with sufficient funds?

Q: How Will WalletHub Save Me Money?

A: WalletHub automatically hunts for better deals on financial products so that you can save money every day. And if your credit isn’t perfect, we’ll help you improve it, enabling you to save thousands each year on your credit cards, mortgage, auto loan, student loan, car insurance, and more.

Beyond your credit score, the WalletScore and net-worth tracker will help you improve your overall financial health. Our budgeting tools and spending insights also ensure your money is used for the things that matter the most.

Q: What Budgeting Methods Work on WalletHub?

You can use any major budgeting strategy on WalletHub, from envelope budgeting to zero-based budgeting. The great thing about budgeting on WalletHub is that you can customize things to your preferences and easily switch between budgeting methods without losing any customizations.

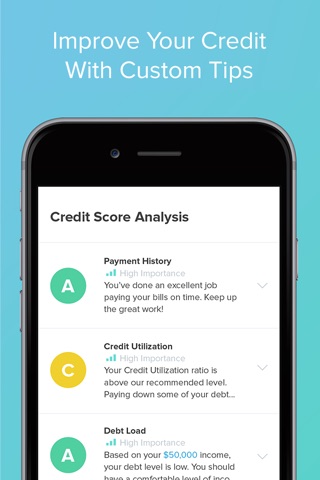

Q: How Can WalletHub Help Me Improve My Credit?

A: WalletHub analyzes your latest credit score and report to identify your financial strengths and weaknesses. We then run a number of simulations to determine how different actions will impact your credit standing. Finally, we present you with a customized credit-improvement plan, along with a comprehensive credit scorecard.

Q: How Does 24/7 Credit Monitoring Work?

A: WalletHub’s free credit monitoring will notify you whenever there is an important change on your TransUnion credit report. In addition to email alerts, you can also customize your WalletHub account to send SMS alerts, which most services don’t provide.

Q: Is WalletHub a Good Mint Replacement for Budgeting?

Yes, WalletHub provides all the features people love about Mint plus more, so give it a try and let us know what you think!